RE-Imagine Your Retirement

Your Portfolio Designed Correctly - Reflecting Your Values - Your Needs - Your Dreams

Be Proactive About Your Future

You've saved for your retirement, and you're thinking about what's next - and you have questions:

Where your income is going to come from each month when you stop working?

What tax traps may I run into?

When do I take Social Security?

What kind of Medicare plan should I pick?

How do I put it all together in a Plan I understand?

Our primary focus is in helping people redesign their portfolios correctly for the new season of retirement they are about to enter or are in. We use financial planning strategies to help you live your life on your terms, in accordance with your values.

Your Team

Working for you since 2010

Debbie Majher, Dave Majher, Rookie

Our goal is to help you have peace of mind and confident in your choices as you head into retirement.

Dave has been helping people navigate through the maze of Medicare Health insurance since 2010. He takes his time to unravel the parts of Medicare so it is fresh and clear in your mind.

Debbie has been a Certified Retirement Counselor and has been helping people successfully save and transition into their retirement phase of their life.

Rookie keeps us in line and accountable. You'll also find him dispensing his wisdom through his "Rookie Facts".

We formed Evergreen Retirement Services in 2016 to bring our combined strengths under one umbrella.

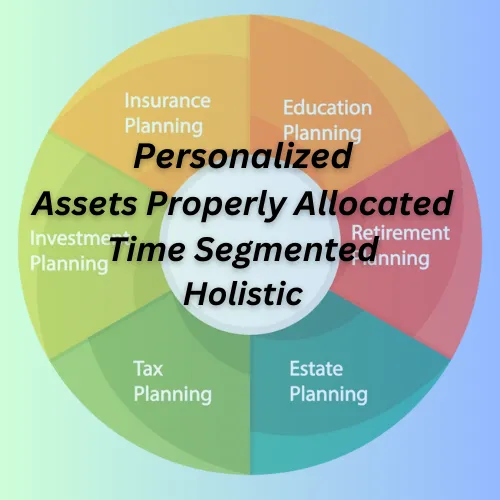

Our PATH Planning Process

Get clear on where you are now, where you want to go, and how you're going to get there.

Discover

We ask the right questions and listen carefully to your values, concerns, needs, and goals.

Design

We work to design a plan that incorporates your Personal priorities; Asset Allocation that mathematically fits your season of life, with Time horizons so there aren't surprises, and Holistically bringing the many aspects of a financial plan together in one place.

Implement

We help you and are with you along your journey.

Safeguard the Legacy of Your Family against Tomorrow's Uncertainties

Don't leave your retirement funds to chance and live the retirement life you want

Tax planning/Minimizing taxes

Correct Portfolio Alignment

Know where you are, where you're going, and How to get there

CONTACT US:

Dave Majher: [email protected]

Debbie Majher: [email protected]

Rookie: [email protected]

Office: 216-616-9797

Open Hours: By Appointment both in Office and Virtually

DISCLAIMER:

This website is for informational purposes only, and should not be taken as investment advice for your situation. Investment services are provided through Evergreen Wealth, LLC, and insurance services are provided by Debora Majher and/or David Majher, independent insurance agents.

Market Guard is a firm that provides investment signals, as well as portfolio allocation recommendations, for a wide variety of model portfolios. Market Guard does not offer advice or enter into fiduciary relationships. Market Guard does not act as a fiduciary to any advisor or any clients of advisors through the use of Market Guard. Market Guard does not provide advice or recommendations to buy, hold, trade, or sell any investment in any jurisdiction through the site. It is the responsibility of the advisor to understand the client’s financial situation, goals and objectives and the risks associated with an investment strategy to determine if it is appropriate for a client’s particular situation. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful. The information on this site does not constitute a solicitation for the purchase or sale of any security and is not a recommendation of any kind. The information is intended for informational and education purposes only. Past performance does not guarantee future results.